By Mr. C.C. Wang

President of TAMI

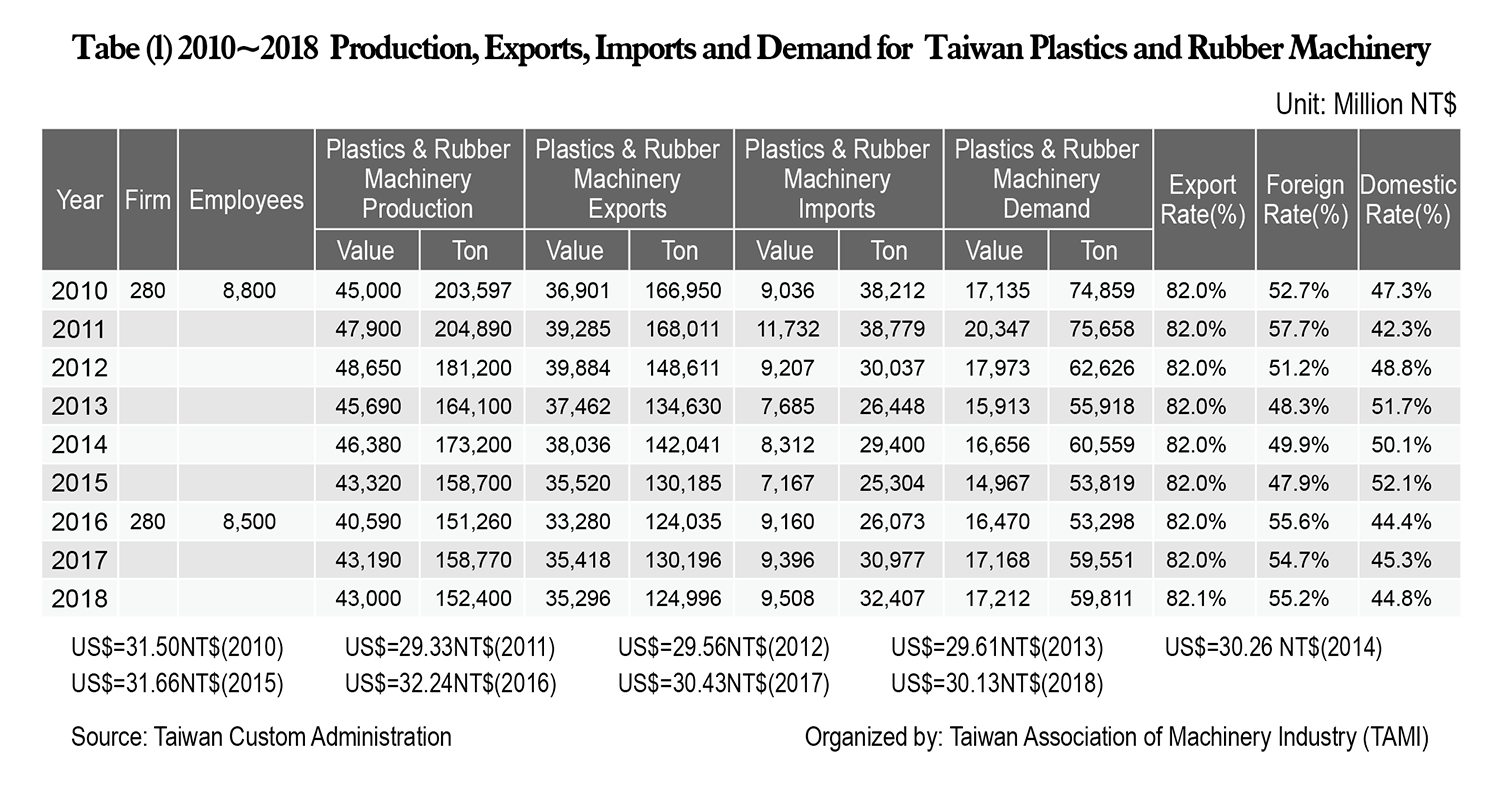

The world economy performance in 2018 remained stable and the production of plastics machinery from Taiwan resulted in a total of 43 billion NT dollars. This production value was somewhat similar to 2017. In 2018, Taiwan exported plastics machinery worth a total of 1,171.47 million US dollars, which was a 0.6% increase. On the other hand, the import of plastics machinery to Taiwan was 315.58 million US dollars, representing a 2.2% increase.

Based on the plastics machinery production figures and sales reports, indications were that plastics processing and product manufacturing are still highly labor-oriented. In past years, the traditional plastics production has been outsourced and the electronics technology has undergone vast development, forcing the plastics processing and product manufacturing to transform and adapt to the precision manufacturing demand that has been quickly growing in Taiwan. In other words, the need for automated machinery is increasing while the need for traditional machinery is decreasing. The export percentage over the total production value in the past also shows that the exports amounted to 62% in 1992, 75% in 1995, and had increased to 82% in 2017 and 2018. Industry critics pointed out that the export percentage would only increase slightly in the future. Taking into account all local purchases, imports account for the same as those locally produced, while the high-end machinery still relies mostly on imports. Because of this situation, it is worthwhile for the plastics machinery industry to rethink their strategy for the future.

Most of the Taiwanese plastics machinery producers are small to medium enterprises (SMEs). Among these approximately 300 Taiwan companies, 98% of them are SMEs and 90% of them are clustered in Tainan, Taichung, and Hsinchu, where they have become an iconic industry in these regions. In the early days, many plastics machinery factories’ employees learned the professional skills and left to establish their own businesses. Their supply chains were identical to one another, and this had led to even more fierce homogeneous competition in Taiwan. A possible solution to this competition is to integrate among these manufacturers, supply differentiating products, and set a clear contrast between one’s products’ applications and markets as well as to enhance their services and production quality. Avoiding price competition means less direct competition between the Taiwan manufacturers, and this goal can only be realized when the Taiwan plastics industry reaches a consensus and is willing to integrate and differentiate their production.

Taiwan Plastic Machinery Status

The production had dramatically increased by 50% in 2010. In 2011, the production value reached 47.9 billion NT dollars and increased 6.4%. In 2012, the production value was 48.6 billion NT dollars and increased 1.6%. In 2013, the value was 45.6 billion NT dollars and decreased 6.1%. In 2014, the value was 46.3 billion NT dollars and increased 1.5%. In 2015, the value was 43.3 billion NT dollars and decreased 6.6%. In 2016, the value was 40.6 billion NT dollars and decreased 6.3%. In 2017, the value was 43.1 billion NT dollars and increased 6.4%. Then in 2018, the value remained similar as 2017 at 43.0 billion NT dollars. The average annual revenue of each member among these 300 manufacturers is 140 million NT dollars, which is double the value compared to the average value of 80 million NT dollars for overall machinery manufacturing. For more plastic machinery production values, see table (1).

When value is categorized by product type, injection molding machinery accounts for the largest for both production amount and value. Its major exporting countries are China and Hong Kong, Vietnam, Indonesia, India, Thailand, Japan, USA, Malaysia, and Turkey. The second largest product type is extrusion molding machinery, the third is blow molding, and the rest in sequence are vacuum forming, thermoforming, tire-making machinery, and other custom-made machinery.

Export Status of Taiwan Plastic Machinery

Based on the import and export report prepared by the Taiwan Customs agency, Taiwanese plastics machinery export numbers shifted hugely in the past 5 years. The total export value in 2011 was 1.34 billion USD dollars, then it went to 1.35 billion US dollars in 2012, 1.26 billion US dollars in both 2013 and 2014, 1.12 billion US dollars in 2015, 1.03 billion US dollars in 2016, 1.16 billion US dollars in 2017, and 1.17 billion US dollars in 2018. A more detailed analysis is shown as the following:

By Product Types

plastics machinery exports, with a total value of 346.2 million US dollars that accounted for 28.0% of overall export and decreased 4.7% compared to 2017. The second largest product category in export was injection molding, with total value of 262.37 million US dollars and 4,697 machines sold, which accounted 22.4% overall exports and decreased 5.7%. The third was extrusion machinery, with total value of 139.91 million US dollars, 1,331 machines sold, and accounted 11.9% overall. The fourth was blow molding machinery, with total value of 93.26 million US dollars, 971 machines sold, and accounted 8.0% overall with a 17.1% increase. The fifth was vacuum and thermoforming machinery, with a total value of 71.38 million US dollars, 1,438 machines sold, and accounted 6.1% overall. The rest in sequence were other molding making type and tire-making machinery.

By Export Destination

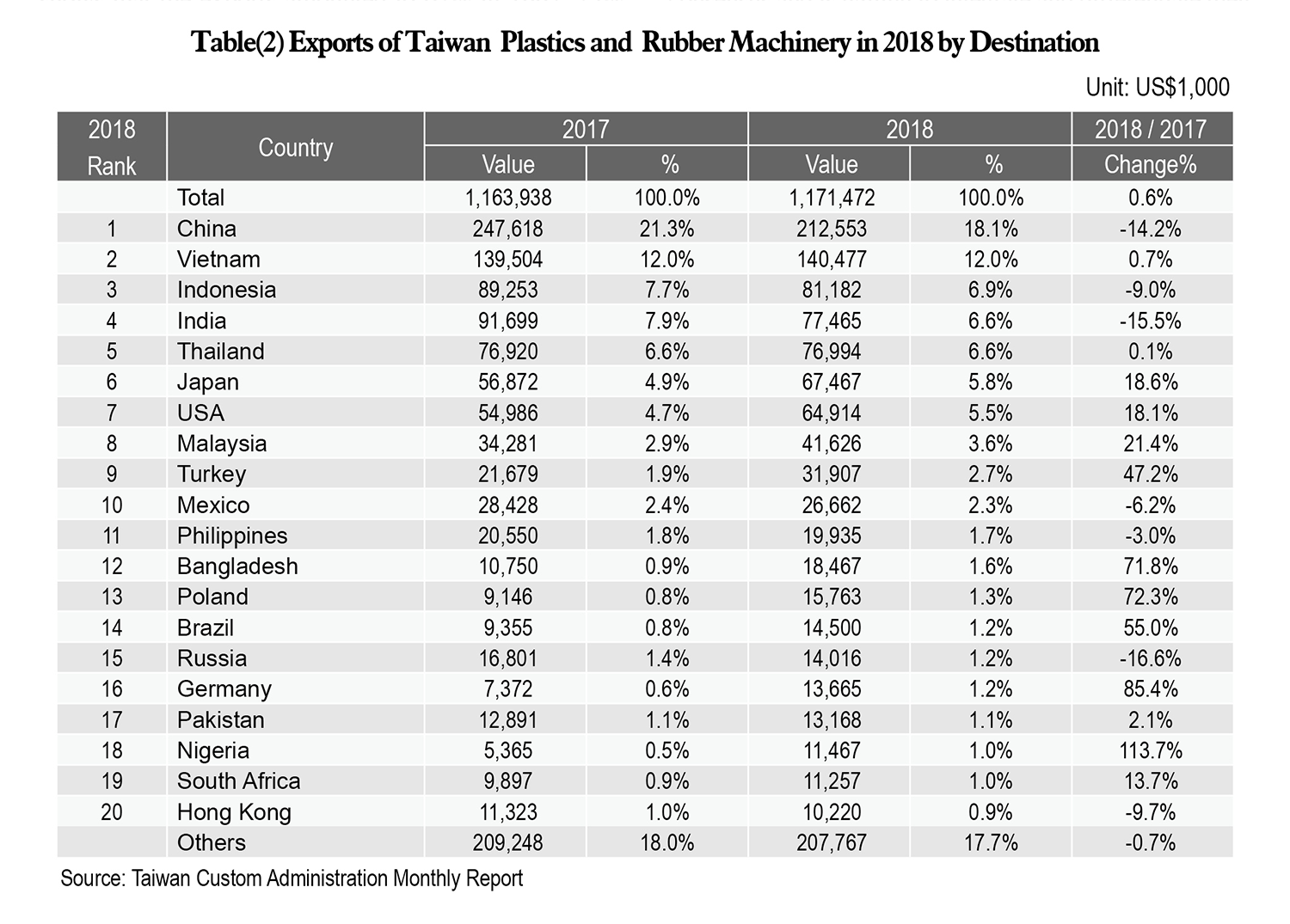

In 2018, the total export value of Taiwan plastics machinery was 1,171.47 million US dollars, which increased 0.6%. Among all the exports, the top export destination was to China, with a total value of 212.55 million US dollars, accounting for 18.1% of overall export with a 14.2% decrease compared to 2017. The second largest destination was to Vietnam, with a total value of 140.47 million US dollars, accounting for 12.0% overall and increased 0.7%. The third was to Indonesia, with a total value of 81.18 million US dollars, accounting for 6.9% overall and decreased 9.0%.

The rest of the export destinations for Taiwan machinery in sequence were India 6.6%, Thailand 6.6%, Japan 5.8%, USA 5.5%, Malaysia 3.6%, Turkey 2.7%, and Mexico 2.3%. These top 10 export destinations represent around 70% of all the Taiwan plastics machinery export.

By categorizing the exports into larger regions, Asia and North America are ranked as the major markets for Taiwan plastics machinery export, where Asia accounts for up to 60% and therefore is still viewed as the top market for Taiwan plastics machinery exports. Among all these exports to Asia region markets, most of them are small and medium scale plastics processing and product builders; whereas in Europe, it has long been the plastics machinery supplying region and the majority of plastics machinery being used in Europe come from Germany and Italy. As the result, Europe markets have occupied up to 60% of Italian plastics machinery exports. A similar percentage of 60% also applies to German plastics machinery exports. As the result, Taiwan plastics machinery being exported to Europe is still comparably low.

Even though China was still the largest export destination for Taiwan machinery in 2018, there are many market shifts happening there in the past recent years. From 2005 to 2011, new policies such as macro-economy control and stricter rules on customs tax exemptions had affected Taiwan machinery exports to China. However, China still imported the high-end plastics machinery primarily from Germany and Japan. In 2014, China accounted 28% of Taiwan’s overall plastics machinery exports. Moving on in the following years, the percentage shifted to 20% in 2015, then 19% in 2016, 21% in 2017, and again decreased to 18% in 2018. For the detailed information on Taiwan export destinations, see table (2).

Import Status of Taiwan Plastic Machinery

Taiwan plastics machinery imports have gone through some unstable fluctuations in the past 5 years. The total value of imports reached 400 million US dollars in 2011, 310 million US dollars in 2012, 260 million US dollars in 2013, then it increased 5.9% to 274 million US dollars in 2014, and a 17.6% decrease to 226 million US dollars in 2015, a 25.5% increase to 284 million US dollars with in 2016, a 8.7% increase to 308 million US dollars in 2017, as well as 315 million US dollars with a 2.2% increase in 2018. More information on import by origin and product types are also shown as the following:

By Product Types

To view the Taiwan plastics machinery industry by product types in 2018, injection molding ranked the top with a total of 89.3 million US dollars, 1,715 machines imported, and accounted for 28.3% of overall plastics machinery imports. The second largest machine type was the other-type machinery with 49.09 million US dollars, 2,107 machines imported, and accounted for 15.6% overall. The third largest import was the extrusion molding, with 47.83 million US dollars, 344 machines imported, and accounted for 15.2% overall. The rest in sequence were blow molding, vacuum forming and thermoforming, and the tire-making machinery, etc.

By import origin

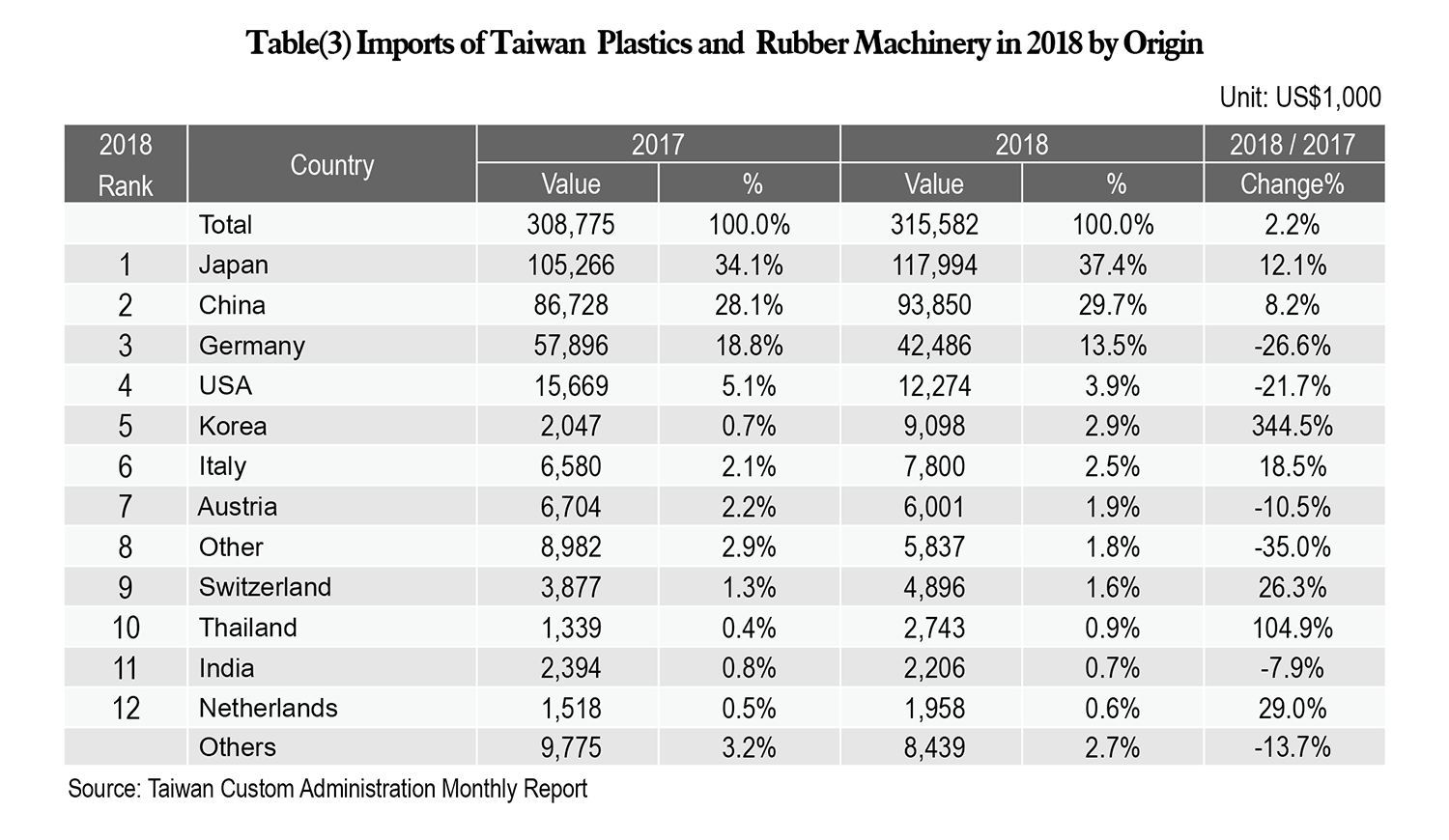

The total value of all plastics machinery import to Taiwan in 2018 totaled at 315.58 million US dollars. Among them, Japan supply ranked at the top with 117.99 million US dollars, which increased 12.1% and accounted for 37.3% overall. The second largest import came from China, with a total value of 93.85 million US dollars, increased 8.2%, and accounted for 29.7% overall. The third largest region came from Germany, with a total value of 42.48 million US dollars and a 13.5% market share. The rest in ranking were USA at 3.9% and Switzerland at 2.5%.

The major players for Taiwan plastics machinery 2018 imports came from Japan, China, and Germany, which amounted to nearly 80% of all the plastics machinery imports to Taiwan. For more detailed information on Taiwan plastic machinery import origin, see table (3).

Global Plastic Machinery Export Status in 2017

The largest plastics machinery producers were Germany, China, Japan, Italy, USA, Taiwan, and Korea, while Germany is the biggest producer and exporter among all of them. On the other hand, China remained the largest importing and purchasing country. Other countries like Japan, Italy, USA, Taiwan, and Korea are viewed as critical suppliers for plastics machinery export.

In 2017, Germany, China, Japan, Italy, USA, and Taiwan contributed a total of 17.8 billion US dollars on worldwide plastics machinery exports, while the total worldwide export and trade was roughly 20.0 billion US dollars. This means that the top 6 exporting countries accounted for up to 90% of all the plastics machinery exports globally. Aside from the top 6 countries, other iconic producers in the industry also include Korea, Switzerland, Austria, Canada, France, UK, and India.

To examine the total export value from each top exporting country in 2017, Germany exported 6.0 billion US dollars, China exported 4.05 billion US dollars, Japan exported 2.56 billion US dollars, Italy exported 2.38 billion US dollars, USA exported 1.62 billion US dollars, and Taiwan exported 1.16 billion US dollars. Comparing these 6 exporting countries’ value from 2016 to 2017, the value showed a 12.0% increase 2.0 billion US dollars.

Germany Export Status

Germany is still the leader for the plastics machinery industry worldwide, of which their trade value could count up to nearly 30% of the overall trade globally. In 2017, their export value reached nearly 6.0 billion US dollars and increased by 9.6% compared to its previous year. However, it still decreased 3% when it was compared to its own export in 2013. Another point worth noticing was that the export value of Germany’s plastics machinery was much more than the export value of China.

The top export destination for German machinery in 2017 was to the USA, which grew 12.8% to 959 million US dollars and accounted 16.0% of all the German plastics machinery export. The second largest destination was to China, an 18.2% increase to 815 million US dollars and accounted 13.6% overall. The third largest destination was to Mexico, a 6.3% increase to 302 million US dollars and accounted 5.0% overall.

China Export Status

China has become the largest country for plastics machinery production, import, and purchasing, and their exports were also elevated and ranked as the second largest globally. In 2017, China exported plastics machinery worth a total of 4.05 billion US dollars, which increased 15.3% compared to its previous year. Overall, China’s plastics machinery exports still massively exceeded the value from Japan and Italy; however, most of their machinery being exported were majorly on low to medium quality and pricing products.

The top market for China plastics machinery exports in 2017 was to the USA, which massively increased 58.4% to 419 million US dollars and accounted 10.4% of all the China plastics machinery export. The second largest export was to Vietnam, a 24.6% to 375 million US dollars and accounted 9.3% overall. The third was to India, a 0.9% decrease to 252 million US dollars and accounted 6.2% overall.

Japan Export Status

Japan is one of the major countries for plastics machinery production and export in Asia. Twenty years ago, the Japan-made plastics machinery was still dominating the market, but the growing market share from Taiwan, Korea, and China has placed much pressure on Japan machinery exports. In 2017, the total export value of Japan plastics machinery increased 19.9% to 2.56 billion US dollars, which ranked Japan as the top third exporting country globally.

The top market for Japan plastics machinery export in 2017 was to China, which increased 48.4% to 902 million US dollars and accounted 35.2% of Japan’s plastics machinery export. The second largest destination was to the USA, a 13.5 decrease to 337 million US dollars and accounted 13.2% overall. The third was to Korea, which increased 46.8% to 215 million US dollars.

Italy Export Status

Italy is an important producer and exporter in contributing to the worldwide plastics machinery industry, where it used to be the second largest exporter just behind Germany; however, Italy has been losing its market share partially due to the strong Euro against USD. In recent time, the Euro exchange rate has lowered and thus allowed Italy to regain machinery sales. In 2017, the Italian plastics machinery ranked the fourth, with a total value of 2.38 billion US dollars and a 12.5% increase.

The top export destination for the Italian plastics machinery was to the USA, which increased 20.5% to 222 million US dollars and accounted 9.3% of all their plastics machinery export. The second largest destination was to Germany, a 18.9% increase to 185 million US dollars and accounted 7.8% overall. The third largest was to France, a 30.7% increase to 125 million US dollars and accounted 5.3% overall.

USA Export Status

The USA was the third largest producing region and exporting market for plastics machinery compared to Europe and Asia. In 2017, the total value of the USA plastics machinery export reached 1.62 billion US dollars, which ranked the fifth place globally and marked as a 0.5% decrease compared to its export in previous year.

The top export designation was to Mexico, which increased 0.5% to 402 million US dollar and accounted 24.9% of all their plastics machinery export. The second largest was to Canada, a 5.1% decrease to 291 million US dollars and accounted 18.0% overall. The third largest was to Germany, a 2.2% increase to 167 million US dollars and accounted 10.4% overall.

Taiwan Export Status

Taiwan is one of the most important exporting countries for the global plastics machinery industry, and it has been exhibiting with large pavilions at some of the largest exhibitions worldwide like Germany’s K show, China’s Chinaplas, Japan’s IPF, USA’s NPE, and Italy’s PLAST. In addition, the Taipei PLAS from Taiwan is a globally renowned exhibition for the global plastics industry. In 2018, Taiwan exported a total of 1.17 billion US dollars, which increased 0.6% and ranked Taiwan the sixth largest plastics machinery exporter worldwide.

The top market for Taiwan exports in 2018 was to China, with a total value of 212 million US dollars, decreased 14.2%, and accounting for 18.1% of all the Taiwan plastics machinery export. The second largest export was to Vietnam, a 0.7% to 140 million US dollars and accounted for 12.0% overall. The third was to Indonesia, a 9.0% decrease to 81.18 million US dollars and accounted for 6.9% overall.

Current Issues and Prospects

Roughly 85-90% of worldwide production comes from Germany, China, Japan, Italy, USA, and Korea. In 2015, the global total production value of plastic machinery reached 29 billion Euro. Among all these 7 major producing countries, Germany produced 7 billion Euro, China produced 8.6 billion Euro, Italy produced 2.5 billion Euro, the USA produced 1.9 billion Euro, Japan produced 1.8 billion Euro, and Taiwan produced 1.6 billion Euro.

Looking at global plastics machinery exports, Germany, China, Japan, Italy, USA, and Taiwan have shared 90% of all exports. In 2017, Germany exported 6.0 billion US dollars, China exported 4.05 billion US dollars, Japan exported 2.56 billion US dollars, Italy exported 2.38 billion US dollars, the USA exported 1.62 billion US dollars, and Taiwan exported 1.16 billion US dollars.

The worldwide plastics machinery exports are still majorly produced and sourced from Europe and Asia regions, especially now that Asia is undergoing an impressive increase in economy through industrial growth. As a result, it is expected that Asia will become the most critical production hub for the world, and the continuing strong demand for plastics machinery in Asia will be a beneficial factor to bring upon more development to both China and Taiwan’s plastics machinery industry.